The geopolitical stakes of global energy have never been higher in the recent times — as crude oil assumes the centre-stage of policy brinkmanship.

The Trump Administration has upped its ante against the countries buying Russian crude oil, warning them of penalties that could certainly include higher tariffs on their goods shipped to the U.S. The move could be seen as attempt at cornering Russian economically by pressuring its key energy customers and preventing them from purchasing oil from the country.

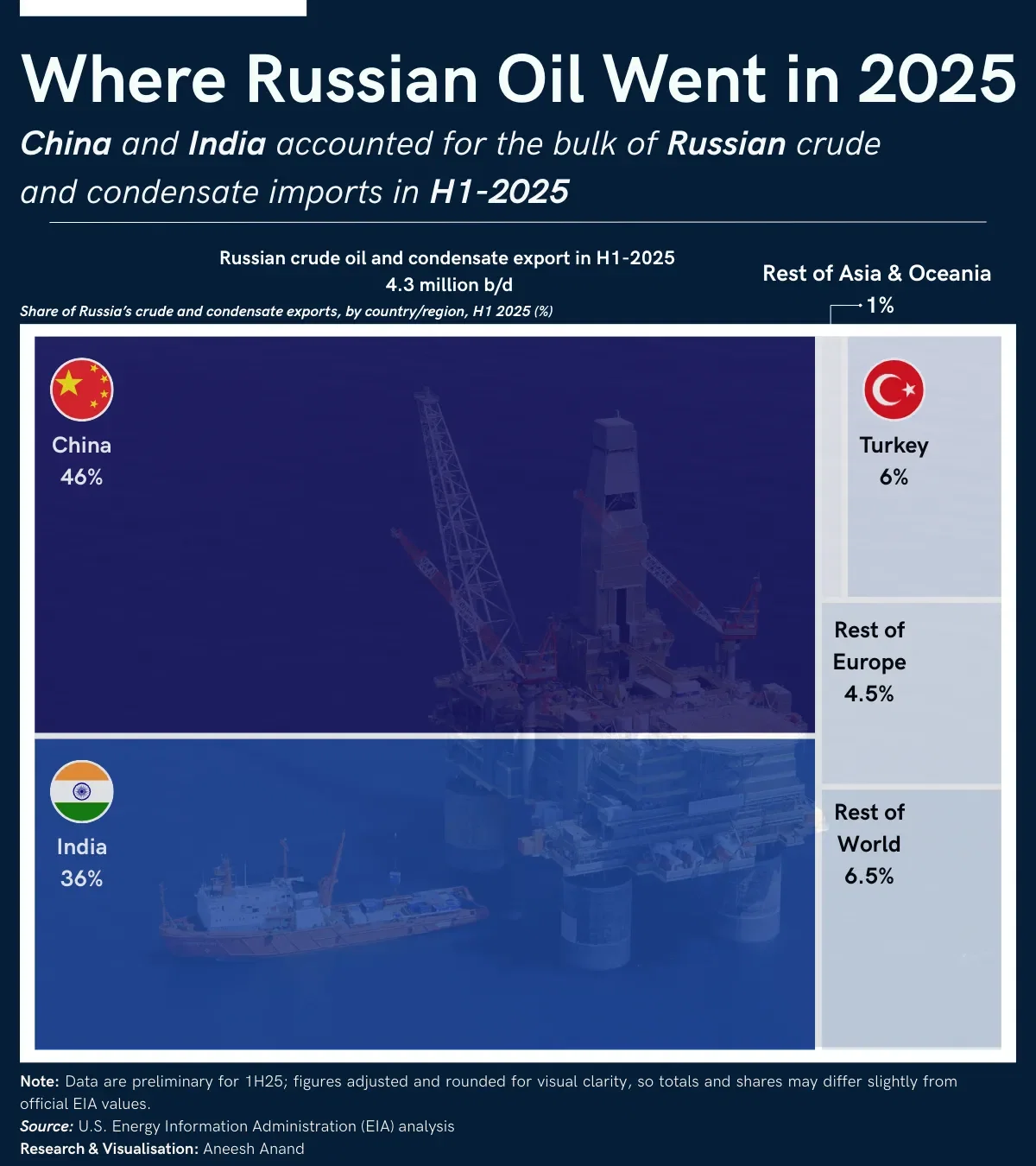

In the first half (H1-2025), Russia's average daily exports of crude oil and condensate exports stood at 4.3 million barrels per day. This chart shows where Russian crude and condensate went in the first half of 2025 — offering a clear view of which economies are most exposed to potential U.S. measures.

Key Takeaways:China: The largest buyer of Russian crude and condensate, taking nearly half of all exports in H1 2025 — which reflects deepening energy ties between the two countries.

India: The second-largest buyer, accounting for over a third of Russia’s crude and condensate exports; already hit with an additional 25% tariff on goods bound for the U.S.

Turkey: Took around 6% of Russia’s crude and condensate exports, making it the largest European destination by share in H1 2025.

Note: Data are preliminary for 1H25; figures adjusted and rounded for visual clarity, so totals and shares may differ slightly from official EIA values.

Dataset by U.S. Energy Information Administration (EIA) analysis

China 46%, India 36%, Rest of Asia and Oceania 1%, Türkiye 6%, Rest of Europe 4.50%, Rest of world 6.50%

[iEpikaira: Και γι' αυτό και οι ΗΠΑ την επιβράβευσαν ΕΔΩ!]

Source: https://www.voronoiapp.com/geopolitics/Where-Russian-Oil-Went-in-2025-6197

.png)